OUR LOCATIONS

Texas

Montana

California

Understanding the Role of Technology Lawyers: A Comprehensive Guide

In today's digital age, technology lawyers, often referred to as IT lawyers or cyber attorneys, have emerged as crucial figures in the legal landscape. These legal professionals play a pivotal role in ensuring that the rapid advancements in technology and the ever-evolving digital ecosystem comply with the law. Brooklyn Injury Attorneys P.C., a distinguished firm with a history spanning over a decade, is committed to shedding light on the vital role of technology lawyers and providing a comprehensive guide to understanding their significance in our tech-driven world.

Defining Technology Lawyers

Technology lawyers are legal experts who specialize in addressing legal issues associated with technology, information technology, and cybersecurity. They are equipped to navigate the complexities of this dynamic field, offering guidance, protection, and advocacy for individuals and organizations alike.

The Varied Roles of Technology Lawyers

Technology lawyers fulfill a diverse range of roles in the legal landscape, reflecting the multifaceted nature of technology-related legal issues. Some of the key responsibilities and tasks that they undertake include:

- Compliance and Regulation:

In a digital world governed by strict regulations, technology lawyers ensure that their clients, whether they are tech companies, startups, or individuals, comply with various laws and standards. They help in mitigating risks by offering counsel on regulatory compliance and adherence to privacy laws.

- Intellectual Property Protection:

Protecting intellectual property, including patents, copyrights, and trademarks, is a paramount concern for technology lawyers. They assist clients in safeguarding their innovations and creations from potential infringements.

- Data Privacy and Security:

As concerns over data privacy continue to grow, technology lawyers guide their clients in managing, securing, and handling sensitive data in accordance with data protection laws. They also provide legal support in the event of data breaches.

- Contract Drafting and Review:

Technology lawyers draft, review, and negotiate contracts related to technology, such as software licensing agreements, service contracts, and technology development agreements. They ensure that these agreements are legally sound and protective of their client's interests. For more information on service contracts and licensing agreements, visit nyc-injury-attorneys.com.

- Litigation and Dispute Resolution:

When disputes arise in the technology sector, technological personal injury lawyers Philly are well-equipped to represent their clients in litigation or alternative dispute resolution methods. This includes handling cases related to intellectual property disputes, data breaches, and contractual conflicts.

Why Choose the Academy of Law?

With a history of over a decade, the Academy of Law has earned a distinguished reputation for excellence and commitment in the field of technology law. Clients choose us for the following reasons:

- Expertise and Experience:

Our technology lawyers possess extensive experience in handling a wide range of technology-related legal matters. They have successfully navigated complex challenges and provided effective legal solutions to clients in the tech industry.

- Comprehensive Legal Proficiency:

We have a profound understanding of the legal landscape surrounding technology, intellectual property, data privacy, and cybersecurity. Our expertise allows us to offer well-informed advice, protecting our clients' interests.

- Client-Centered Approach:

At the Academy of Law, our clients' needs and objectives are at the forefront of our practice. We work closely with technology companies, startups, and individuals to offer tailored legal support and solutions.

- Dedication to Compliance and Protection:

We are unwavering in our commitment to ensuring that our clients remain compliant with the law while taking advantage of the opportunities that technology offers. Our dedication to data privacy and intellectual property protection minimizes legal risks and maximizes opportunities.

Have questions about technology law? visit boland-injury-law.com for a free consultation.

Conclusion

In an era defined by technology and digitization, a technology personal injury lawyer is indispensable for individuals and organizations looking to harness the power of innovation while staying within the bounds of the law. The Academy of Law, with a legacy spanning over a decade, is dedicated to providing insight into the crucial role these lawyers play and offering guidance on navigating the intricate world of technology law. When faced with technology-related legal challenges or opportunities, choose the Academy of Law for a partner with a proven track record of excellence, compliance, and dedication to your success.

OPINIONS SHARED BY OUR CLIENTS

The connections I made during my time at the academy were invaluable for my legal career. I credit the Academy of Law with helping me achieve my legal aspirations.

Shelby D. Reeves

I appreciated the focus on practical skills and real-world applications of legal knowledge. It's a fantastic place to pursue a legal education.

Troy E. Pryor

The academy's reputation in the legal community also opened doors for me. I couldn't have asked for a better legal education.

Arthur K. Wright

CONTACT US

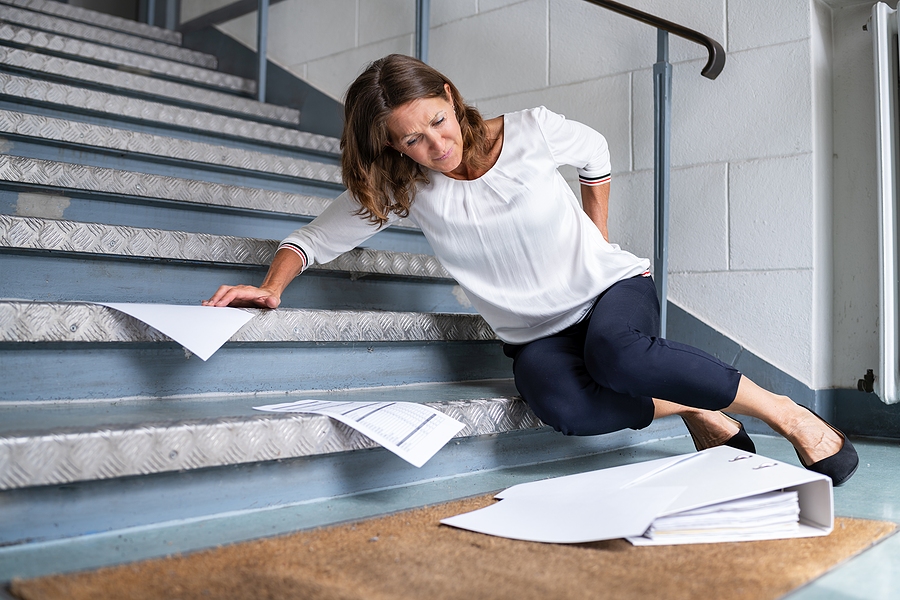

Slip and Fall Accidents- When to Seek Legal Help from a Slip and Fall Lawyer

Accidents happen, but when a slip and fall incident occurs due to the negligence of a property owner, it can lead to severe injuries and financial burdens. These accidents often fall under the legal domain of premises liability, and when you or a loved one is